INTRODUCTION

The compartment IPC Technology Investment Sleeve Portfolio 1 (2025), has exclusive holdings of 5 portfolio companies: 1 mid-stage and 4 ‘early-stage’ AI focused technology companies and a global digital platform and was constructed with synergies between the underlying portfolio companies.

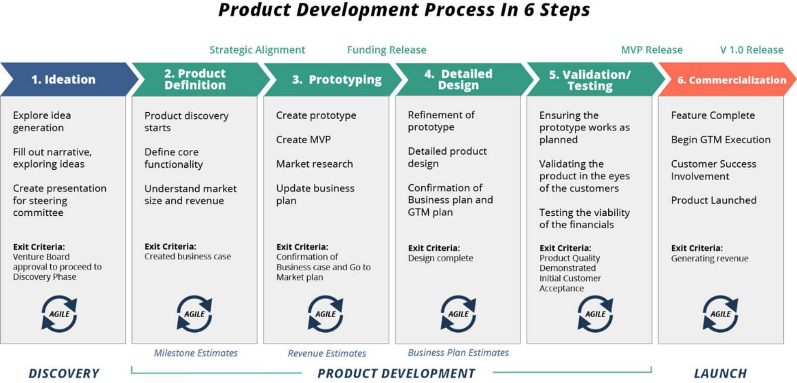

Leverage Global AI ecosystem orchestration digital platform to deliver a comprehensive ecosystem to global partners (AWS, MSN, Google, Dell). The greatest value creation for the portfolio is targeted at between stages 5 and 6 (as per illustration below).

Management Team with best-in class technically proven solutions

Proven Team: The team are former leaders from KPMG, McKinsey & Co. BearingPoint, Fujitsu, Amdhal. AT&T, Ericsson, Microsoft, GE, AWS and Under Armour

Proven Track-record: The Management team has transformed the business from a Professional Services company to a SaaS business; expanded the customer footprint from European centric to Global; and expanded the software from being a telco BSS solution to a Digital Commerce platform.

Compartment iPC Technology Investment Sleeve Portfolio 1

Companies held within the

Investment Portfolio are:

A. AI-powered ecosystem orchestration and digital Platform Company

B. Healthcare AI-powered Revenue Cycle Platform Company

C. A unified AI platform for seamless and secure IDENTITY verification

D. Multi-modal AI engagement & experience automation for Recruitment

E. Generative AI Platform for end-to-end Media Context Audio Localization

A. AI-powered ecosystem orchestration and SaaS Digital Commerce Platform Company

Investment Thesis: Investment Thesis: Technology Portfolio has invested in an Al-powered ecosystem orchestration and digital platform that is industry agnostic. SaaS company providing Digital Commerce Platform solutions to Telco and Tech sector. The company has specialist software that is used globally by Telcos and Tech companies. The technology platform was founded in 1989 and developed over 35 years. The company was spun out of a Big 4 Accounting / Consulting firm via a Management Buyout in 2021. Clients in AWS, NTT, T-Mobile, Tata Communications. Strategic partnerships with AWS, Google, Microsoft, intel and Dell and Verizon. The company overlays or replaces existing IT infrastructure, making it easy/fast for companies and their partners to create and sell high value repeatable products/solutions and to hyper automate end-to-end. The TAM

B. Healthcare AI-powered Revenue Cycle Platform Company

Investment Thesis: A AI Healthcare Platform with a deep understanding of the finances of healthcare. The technology platform was developed over ten years that automates the tedious manual process of collecting the US$3.8Trilion spent on healthcare. By automating these processes billions of dollars are saved by healthcare institutions (hospital & health system, Physician & Medical Groups, Health Services Companies) . Clients include the Veteran’s Administration, Walmart, and Loma Linda.

C. A unified AI platform for seamless and secure IDENTITY verification

Investment Thesis: unique portfolio in a in demand sector of identity management

D. Multi-modal AI engagement & experience automation for Recruitment

Investment Thesis: A unique multi-modal AI platform company. The platform automates all phone interaction processes throughout the entire hiring cycle, from pre-screening and assessment to scheduling, offer release, post offer acceptance documentation, and joining.

E. Generative AI Platform for end-to-end Media Context Audio Localization (Dubbing)

Investment Thesis: A unique Generative AI platform for end-to-end movie dubbing. The company spent the last 8 years developing the deep tech engine to create the world’s first full stack Generative AI platform for end-to-end dubbing powered by computer vision, speech synthesis, voice clones, and prosody transfer.