INTRODUCTION

The compartment IPC Energy Investment Sleeve Portfolio 1 (2025), has exclusive holdings of 5 ‘early stage’ mega-scale Energy Transition and Nuclear Power companies. The portfolio was constructed with synergies between the underlying portfolio companies. For example, the global energy transition platform may be a strategic acquiring of the other companies in the portfolio as it will extend it product / service offerings.

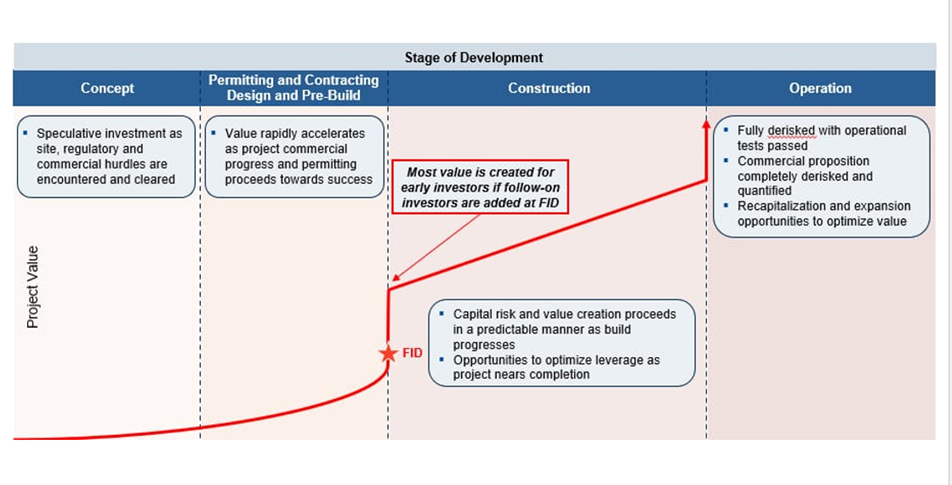

The greatest value creation for the portfolio is targeted at FID at 24 months into the portfolio life cycle (as project management term meaning Financial Investment Decision, when the underlying asset is ready for construction (as per illustration).

The portfolio has exclusive holdings of 5 ‘early stage’ mega-scale Energy Transition and Nuclear companies. The portfolio was constructed with synergies between the underlying portfolio companies. For example, the global energy transition platform may be a strategic acquire of the other companies in the portfolio as it will extend it product / service offerings.

Proven Team: Former C-Level executives at North America largest utilities. The team have extensive experience in leading, financing, and solving the challenges associated with energy transition, and a proven track record of delivering complex, large-scale development projects across various disciplines, including renewable power and storage, hydrogen and ammonia production, industrial and precious metals and large-scale project construction / operations.

Proven Track-record: In aggregate, management have deployed over US$12 billion of capital in the energy and industrial sectors.

Compartment iPC Energy Investment Sleeve Portfolio 1

Companies held within the

Investment Portfolio are:

A. Global Energy Transition Company

B. Energy Transition Hub Company

C. Green Hydrogen Production Company

D. Biofuels Feedstock Supply Company

E. Nuclear Services Company

A. Global Energy Transition Company (Abraxas Power Corp)

Investment Thesis: The Energy Portfolio will take private equity ownership in a pioneering energy transition developer focused on creating value by solving the current and future challenges of the energy transition. The company’s broad mandate allows it to see opportunities across technologies and geographies to transform the global energy industry to unlock superior returns. The company has been awarded over US$9 billion in capital projects, including a mega-scale P2X project in a G7 jurisdiction. The mega-scale project will be one of the largest onshore wind projects in the world producing ~160,000 tonnes of green hydrogen and ~1 million tonnes of 100% green-certified ammonia per year.

a. The company’s strategic development partner is EDF Group. EDF Group is a world leader in low-carbon energy, with a low carbon output of 434TWh, a diverse generation mix based mainly on nuclear and renewable energy (including hydropower). EDF Group supplies energy and services to approximately 40.9 million customers and generated consolidated sales of €139.7 billion in 2023.

b. The company is also supported by Canadian, Newfoundland, Maldives, Sri Lanka and European governments and RBC (top 10 global bank).

B. Energy Transition Hub Company

Investment Thesis: The Energy Portfolio will take private equity ownership in pioneering energy transition developer focused on creating value by supporting the European energy transition. The project is a redevelopment of a former chemicals industrial platform, with circa 200 hectares of premium industrial land, strategically located in an important economic area, with access to utilities such as water, power and road infrastructure. The development plan includes converting the industrial platform to house a state-of-the-art data center, on-site renewable energy generation and storage and a large-scale green fuels production facility.

C. Green Hydrogen Production Company

Investment Thesis: The Energy Portfolio will take private equity ownership in pioneering energy transition developer focused on creating value by supporting the European energy transition through the deployment of a large-scale green hydrogen production facility at that largest planned gas power plant in Europe. The company will enter into a long-term lease agreement whereby the power plant will provide circa 240 hectares of land, an electrical connection, access to the national gas grid and ownership of a nearby dam. The project involves building a solar-photovoltaic plant with electrical energy storage on most of the lands provided, building a green hydrogen electrolyser facility and overhauling the dam and converting it into a hydro power production facility. The route to market involves producing green hydrogen from solar PV and hydro power plants and deliver directly to the gas power plant or with the ability to deliver green hydrogen into the national gas grid transmission line on-site.

D. Biofuels Feedstock Supply Company

Investment Thesis: iPC Energy Portfolio will take private equity ownership in pioneering energy transition developers focused on creating value by supporting the European energy transition through securing large parcels of agriculture land in one of the most fertile regions of Europe, with climate perfectly suitable to grow biofuel crops. The company will purchase the seeds, cover the farmer’s planting and harvesting costs, deliver and refining process into oil as feedstock for biofuels. Feedstock would be then sold to a major European biofuel producer.

E. Nuclear (Power) Services Company

Investment Thesis: The Energy Portfolio has a joint development private equity agreement with a European Nuclear Power services company. The company’s broad mandate Refurbish and build multiple reactors in Romania. The reactors utilizing CANDU Technology – developed by the Canadian Government. Both the US and Canadian governments are providing grants of over 10B USD. Total estimated budget from 2025-2025 is €25 billion.